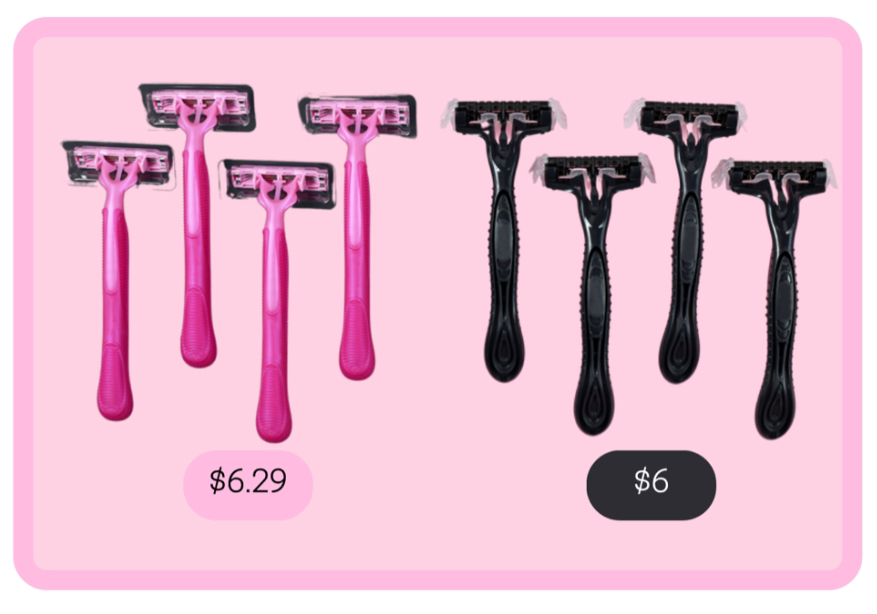

Have you ever wondered what the difference was between men’s and women’s razors even though they are the same product? It’s not just the color of the product, it’s the price. Beginning in the 1990s, the term “pink tax” was used to describe a tax directed to feminine products. From clothing to personal care products, there is a substantial gap between products targeted towards men and women.

The pink tax can significantly affect women financially. According to the New York City Department of Consumer Affairs, products targeted at women are 7% more expensive than those targeted towards men. Additionally, they found that products for senior women were on average 13% more expensive than men’s. Even though there is not a real government-mandated tax on women’s products, the pink tax is still real and is just another example of gender-based discrimination.

The pink tax imposes a lifelong economic burden on women, impacting the products and services they use every day. This may include dry cleaning, menstrual products, and clothing. This issue is worsened by the fact that many women are paid less than men. A recent study, reported by PR Newswire, investigated whether companies were upholding The Equal Pay Act: “Only 13% of organizations studied consider long-term incentives when doing pay equity analysis, and only 24% include short-term incentives in their pay equity analysis.” This proves that even though companies are saying they are paying their workers equally, they are not doing so long term.

Gender inequality and discrimination have been issues for longer than our country has been around. Even though monumental changes have been made, such as women gaining the right to vote, there are still lingering issues that divide the sexes. This problem has resulted in government action: in recent years both New York and California have passed bills that prohibit charging more for gender-based products that have the same use. California’s Bill No. 1287 (prohibits) “A person, firm, partnership, company, corporation, or business from charging a different price for any 2 goods that are substantially similar, as defined, if those goods are priced differently based on the gender of the individuals for whom the goods are marketed and intended.” Similar to the Equal Pay Act, businesses have found loopholes around whether or not products are “substantially similar.” These loopholes allow manufacturers to reinforce the pink tax. For example, in 2021, the Federal Trade Commission investigated the pink tax. They compared the prices of men’s and women’s products that have the same function. It was found that the pricing difference between men’s and women’s products was 10.6%. This substantial difference not only reinforces gender stereotypes but also financially affects women.

More states may adopt a bill similar to California’s that go against gender pricing discrimination, but to encourage this to happen, the people have to take action. Fighting against the pink tax can allow for more progression towards gender equality as well as equal pay.