The Quarter Cut

For the first time this year, the Federal Reserve Board announced cutting the benchmark interest rate.

On September 17, the Federal Reserve’s legislative branch, Federal Open Market Committee (FOMC), met in the Eccles Building and voted to adjust the benchmark interest rate by .25% from 4.25% to 4.00%. Immediately following the report, the stock market soared. Wall Streeters celebrated having received the cut they’ve been expecting since June. According to Federal Reserve Board Chairman Jerome Powell, the reason for the reduction was concern over the job market, which has seen unfortunate, high unemployment rates.

However, there is criticism about the order. Some call for a larger cut and more economic stimulus while others are worried about the risk of an inflation spike up. Those who aren’t financial specialists may be asking: what’s the big deal about a measly .25% decrease? This article clarifies the importance and logic behind changing federal interest rates.

The Federal Reserve Explained

Nicknamed “The Fed,” the Federal Reserve System is the U.S. central bank that serves to monitor the economy, maximize its growth, and prevent and resolve crises. The system is made up of three agencies: Federal Reserve Board of Governors, the 12 Federal Reserve Banks, and Federal Open Market Committee (FOMC).

The Federal Reserve Board of Governors, located in Washington D.C., is essentially the Fed’s leadership team. They oversee system operations and make key decisions. There are 7 members, who come to power through presidential appointment and Senate approval. Members serve 14 year terms and cannot be re-appointed unless their term was not completely fulfilled. Of the seven governors, three would be nominated by the President to be Chair of the Board, Vice Chair of the Board, and Chair for Supervision, and have their position confirmed by Senate vote, much like the entry process to the board. The current position holders are Jerome H. Powell (Chair of the Board), Phillip N. Jeferson (Vice Chair of the Board), Michelle W. Bowman (Chair for Supervision).

Across the United States, there are 12 Federal Reserve Districts each under the management of one of the 12 Federal Reserve Banks. The banks are stationed in areas based on geography and population. Each has their own board of 9 directors who provide a voice for their district’s people in Federal Reserve System decisions and enforce them.

The president of the New York Bank, 4 other Federal Reserve Bank Presidents–rotated annually, and the Federal Reserve Board of Governors together create the Federal Open Market Committee. Like the name suggests, the FOMC manages market operations. They meet 8 times per year to discuss and develop monetary policies. One of the committee’s greatest responsibilities is adjusting the target interest rate accordingly to economic conditions, which they’ve done recently.

More information can be found at the Federal Reserve Board government website.

Cause and Effects

Beginning in November of 2023, the labor sector started exhibiting signs of erosion. The most recent Bureau of Labor Statistic unemployment report showed that the unemployment rate was 4.3% in August, and simultaneously, only 22,000 jobs were added. Analysts previously had estimated that August would bring a job growth of around 75,000. This difference sounded the alarm for the Fed.

In Federal Reserve Chair Jerome Powell’s words, “While the unemployment rate remains low, it has edged up. Job gains have slowed, and downside risks have risen”. A contributing factor Powell says is the falling demand and supply for workers. Low consumer spending and diminishing immigration can be linked to this reduction in demand and supply. Thus, to combat the work force decline, the Fed is choosing to lower the benchmark interest rate.

Loans, credit cards, savings accounts, mortgage, are examples of assets directly affected by the Federal Reserve interest rate. Loans, credit cards, and mortgages are liabilities, money that is owed to a lender, usually a financial establishment, and they charge interest over time. The lower the interest rate, the less the borrower has to pay to the lender. Enterprises need loans from the bank to fund operations and development, which are naturally capital-exhaustive, but directors are hesitant to borrow when interest rates are high due to the inflated cost. With a lesser benchmark interest rate, companies are much more inclined to take loans and start expanding. Subsequently following expansion, businesses would have to hire more workers. Thus, through interest rate adjustment, labor demand rises.

Bumping up the benchmark has the opposite effect–though it is good for restraining inflation and would increase savings account returns.

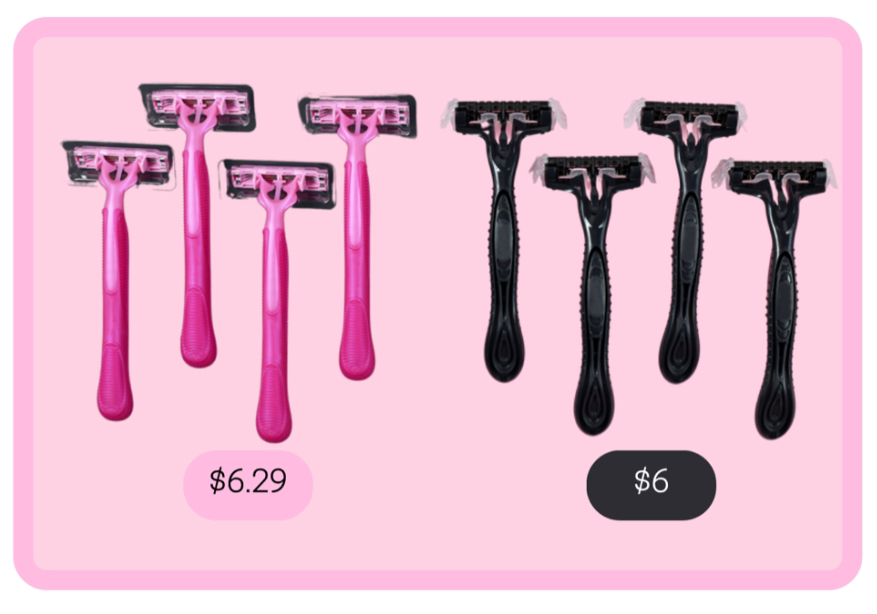

Regarding the 25 basis point change, the economy may not experience significant shifts beside a gradual growth in labor. There are dissenting opinions about the Federal Reserve’s choice. Political figures from both the Democratic and Republican party have expressed desire for additional deductions. Typically, a greater one-time cut would’ve enabled speedier labor market growth and economic productivity. However, due to the Trump administration’s tariff policies, inflation is still lurking around consumer goods. Powell and FOMC members wait to observe the economy until further arrangements.